http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

In 2013, the UPA government imposed a 10 percent import duty on gold. P Chdambaram, the then finance minister was quite savvy about the way financial markets work.

He knew too well, that any import duty above the 5 percent threshold, would inevitably draw the attention of smugglers. But he hoped that official imports would reduce because of the higher duty, and consequently the current account deficit (CAD) would narrow. In his effort to spruce up the books of accounts, Chidambaram ended up making smuggling very lucrative for traders.

Gold has a special appeal for smugglers because it has a high value despite a low volume. That makes the smuggling in of gold easy -- through airports, through passengers as part of personal gold, or even through carriers. Sometimes, when the contraband is large enough, it comes through dhows as well, and the metal is landed somewhere along the porous coastline of India.

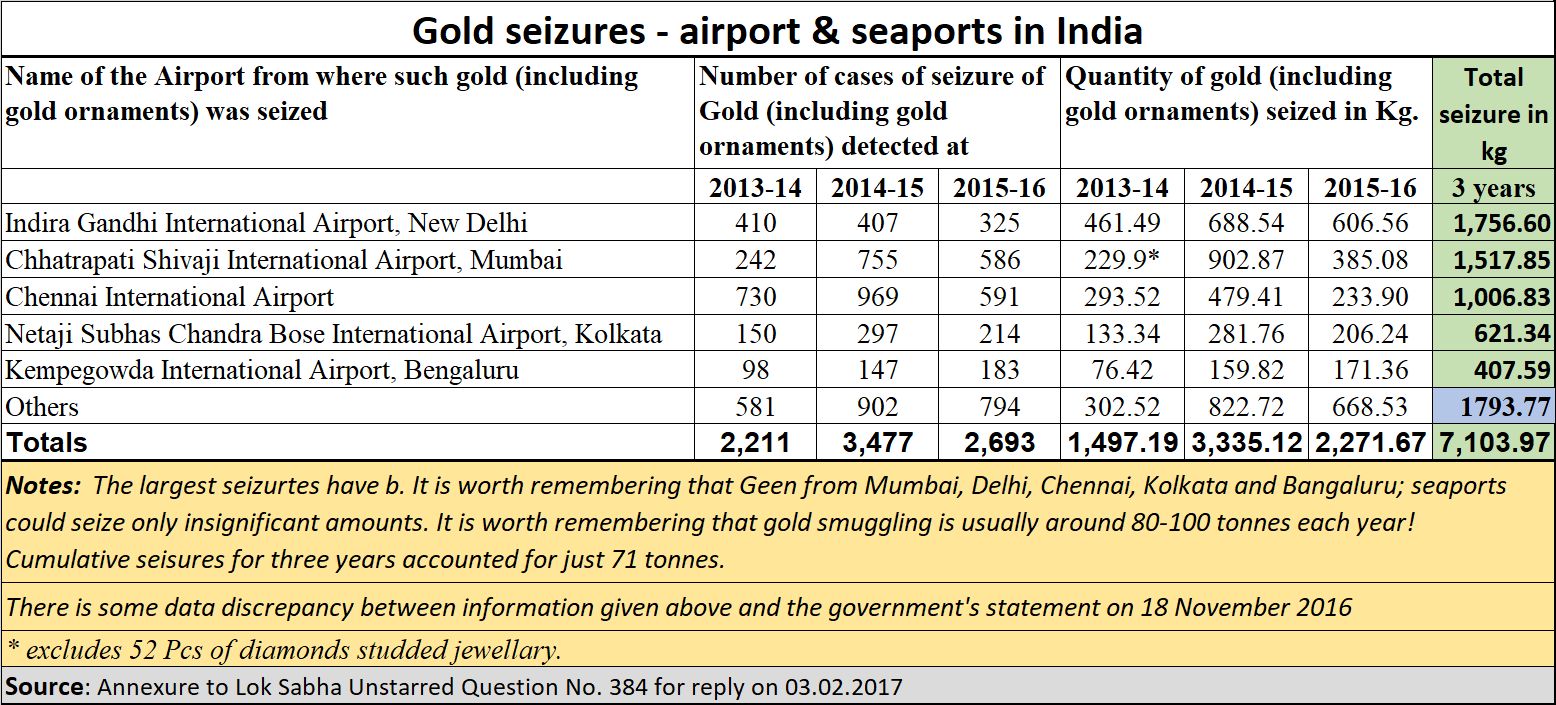

True, the customs seize gold. But as a reply to the Lok Sabha on February 3, 2017 (in reply to the unstarred question no 387) showed, the government admitted that seizures were scant compared to the volume of gold that was being smuggled into India. The government admitted that the Income Tax Department conducted more than 1,100 searches, seizures and surveys and issued more than 5,100 notices, between November 2016 and January 2017, for verification of suspicious high value cash deposits in old high denominations.

Collectively, these raids and seizures accounted for valuables worth Rs. 610 crore which includes cash of Rs. 513 crore. Rest of the seized valuables worth Rs.97 crore was mainly in the form of gold, jewellery and silver. Of the 100 tonnes of gold smuggled in each year, the total seizure accounted for just 0.003 percent!.

In another reply to the Lok Sabha on March 31, 2017 (unstarred question no. 4842), the government stated that “[even though] there are no firm statistics on estimated demand and availability of gold in the country . . . as per rough estimates gold demand in the country is 800-900 tonnes per annum.”.

In yet another Lok Sabha reply (unstarred question No.384 of February 3, 2017), the government stated that the total seizure of gold (and gold ornaments) accounted for just 7.1 tonnes during the latest three-year period (2013-14 to 2015-16). The biggest seizures were in Delhi, followed by Mumbai and Chennai. Remember that the volumes of goldf smuggled in stand at around 80-90 tonnes.

Clearly, smuggled of gold cannot be stopped, and Chidambaram’s 10 percent duty boosted gold smuggling. Then in successive measures, subsequent budgets increased the duty on imported gold to 12.5 percent and now (along with GST) top around 15.5 percent. Smuggling of gold is more attractive than ever before.

So how does gold come in? There are no official documents on this pattern, but common sense suggests that it comes through the porous borders of Nepal, Myasnmar, Bangladesh and by sea and air from Malaysia, Thailand and other neighbouring countries.

The best indicator of how India’s gold policies have made its neighbours richer, and this country itself poorer, can be gleaned from the table alongside. Watch the way gold imports have swelled in countries like Thailand and Sri Lanka which do not have a major domestic market for this yellow market. China and India are the two markets where huge quantities of gold gets absorbed by the local population. This lure for gold is partly on account of sentiment, and partly because of the tremendous faith people have in gold.

Marketmen point to the way gold sales swelled in Kerala immediately after the floods. That was when most common folk saw a great deal of their wealth eroded. What they could carry with them was gold. It is becoming attractive now as well, because of the weakening of the rupee and other global currencies.

The irony is that in an attempt to control the current account deficit, the government believes that a higher import duty on gold will prevent gold imports. What it actually does is dampen official gold imports. Instead, unofficial gold imports swell. That in turn corrodes the value of the Indian rupee and will gradually translate into higher inflation. So an apparently stronger balance sheet will come at the cost of a weakening currency.

If the government wants to prevent this, it must look at gold once again, more sensibly. Till that happens, expect the rupee to continue becoming weaker.