A study of fiscal parameters of states by the Reserve Bank of India (RBI) identified Bihar, Kerala, Punjab, Rajasthan and West Bengal as highly stressed due to their high debt levels, the quality of expenditure and the level of fiscal deficit. These states could face a crisis if they fail to curb non-merit expenditure, the study has warned.

High debt also implies that a state spends a significant share of its revenues on servicing the debt. Several states spend about 10 percent or more of revenue receipts on interest payments, with Punjab and West Bengal spending more than 20 percent.

The study, published in the June edition of the central bank’s monthly bulletin, identified another five states as fiscally vulnerable due to their high debt levels. These are Andhra Pradesh, Haryana, Jharkhand, Madhya Pradesh and Uttar Pradesh. The study group was guided by deputy governor Michael Patra.

Of the 10 stressed states, Punjab seems to be in the most perilous situation, an outcome of years of freebies such as free power to farmers handed out by successive governments. Among all states, Maharashtra is in the most comfortable situation with its debt to gross state domestic product (GSDP) ratio under 20 percent.

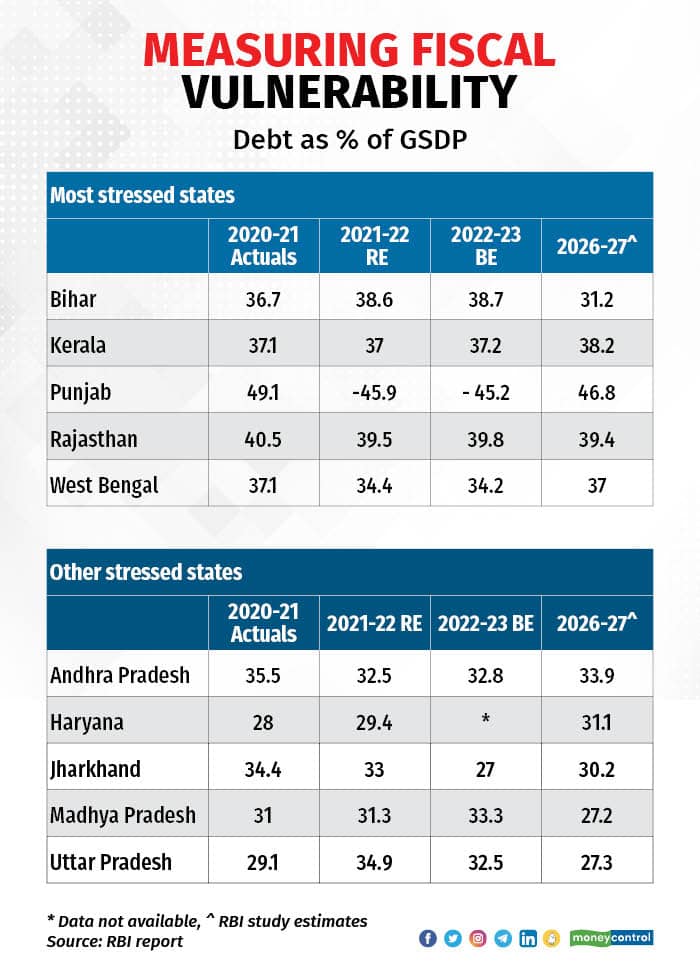

The ratio of debt to GSDP of the five most stressed states is in the high thirties (see chart). The debt to GSDP is an indicator of a state’s ability to repay its debt, and higher ratios mean a high risk of default.

Some of these states breached either one or both the targets for debt and fiscal deficit for 2020-21 set by the 15th Finance Commission due to economic contraction and depressed tax collections.

The study also noted that the share of revenue expenditure in total expenditure in these states was 80-90 percent, which leaves them with little resources for capital expenditure or asset creation.

Low capital expenditure hurts in the medium to long term, as the state will continue to experience slow revenue growth and remain deep in debt. States such as Rajasthan, Kerala, Punjab and Kerala spend 90 percent of their revenue expenditure on paying salaries, pensions and interest on loans.

So how stressed are the five states identified by the RBI? We take a look at their key fiscal indicators.

Bihar

The state’s debt to GSDP ratio for 2022-23 was estimated at 38.7 percent, about the same level as the last fiscal year but higher than the 36.7 percent seen in 2020-21, as outstanding debt continues to expand faster than the state’s economy.

Bihar’s economy is expected to expand about 9.7 percent in nominal terms to Rs 7.45 lakh crore this year.

The outstanding debt of about Rs 2.88 lakh crore in the budget estimates for the current year is about 70 percent higher than it was in 2018-19, the year before India’s economy started slowing. The RBI study estimates that the state will lower its debt to GSDP ratio to 31.2 percent by 2026-27.

As a ratio of the state’s revenue receipts for the current year, outstanding debt is about 146 percent. The state borrowed more than it had budgeted for in 2020-21 and 2021-22 due to a shortfall in revenues.

Expenditure continued to climb faster than revenues. The revised estimates for 2021-22 projected a 48 percent rise in revenue expenditure against a 32 percent rise in revenue receipts from the previous fiscal year.

In the current fiscal year, the state has budgeted to spend Rs 2.38 lakh crore, including Rs 14,670 crore for loan repayment. Of the balance, just about 13 percent is proposed for capital outlay. Over 86 percent of the net expenditure would be on the revenue account, which includes salaries, pension and interest.

The state is highly dependent on central transfers — a share in taxes collected by the Centre and grants—to keep its economy running.

The share of taxes collected by the state, referred to as its own taxes, is just a little more than 20 percent of its revenue receipts. These taxes include state goods and services tax, state excise, stamps and registration. The economic slowdown and pandemic affected its tax revenues but increased grants from the Centre helped.

Kerala

The southern state’s debt to GSDP ratio for 2022-23 was estimated at 37.2 percent, almost unchanged from the ratios for the preceding two fiscal years. The state’s debt to GSDP ratio was below 32 percent in 2019-20, when the state suffered a second successive year of flooding due to heavy rainfall.

The ratio climbed sharply to 37 percent in 2020-21 when the economy contracted about 3 percent and the debt stock climbed 14 percent.

The state has projected a 10.8 percent growth in its nominal GDP to almost Rs 10 lakh crore for the current financial year.

The debt stock of the state as per the budget estimates for 2022-23 stood at Rs 3.71 lakh crore, up 58 percent from 2018-19. As a ratio of the revenue receipts for the current year, the outstanding debt is about 277 percent.

The state has projected a narrowing of the difference in the growth rate of its nominal GSDP and debt stock in the revised estimates for 2021-22 and budget estimates for 2022-23.

However, the debt to GSDP ratio is unlikely to see any significant decline anytime soon—the state has projected it to be 35.7 percent in 2024-25 in its medium-term fiscal policy and strategy statement. The RBI study has estimated it will be 38.2 percent in 2026-27.

The state estimates that the share of its own tax revenues in revenue receipts will bounce back to 55 percent in the current year after falling below 50 percent in the last two fiscals.

The share of resources transferred from the Centre is set to decline to 36 percent in the current financial year from over 41 percent following the improvement in revenue generation from the state.

The state expects its revenue expenditure growth to moderate after a spike in the last two years led to some extent by expenditure related to the COVID-19 pandemic.

The rise in expenditure last year was mostly due to pay revision, payment of dearness allowance arrears and deferred salary payments. Yet, 91 percent of the expenditure net of loan repayment will be on the revenue account in the current fiscal year, with a bulk of it spent on salaries, pensions and interest.

West Bengal

The state’s debt to GSDP ratio for 2022-23 was estimated at 34.2 percent, down from about 37.1 percent in 2020-21. The state has brought down the ratio gradually from 40.7 percent in 2010-11, by slowing the growth of debt stock.

In seven of the last 11 fiscal years, the rise in debt stock was lower than the expansion of the nominal GSDP. The situation reversed in 2019-20 and 2020-21 when the economy slowed. Yet, the debt is very large, with the ratio of debt to revenue receipts for the current year estimated at 296 percent.

The RBI study estimates that the fiscal situation of the state will deteriorate. It expects the debt to GSDP ratio to deteriorate to 37 percent in 2026-27.

The state expects its economy to expand by 11.5 percent to Rs 17.1 lakh crore and its debt to rise 10.9 percent to Rs 5.86 lakh crore in the current fiscal year.

The share of its own tax revenues in total revenues has been fairly steady at 40-42 percent even in the recent slow growth years, while the share of central taxes was been about 30-33 percent. The growth in own tax collections fell marginally in 2019-20 and 2020-21.

The state has budgeted for a slower revenue receipt and expenditure growth for the current year after a sharp pick-up in the last fiscal. The revenue deficit is also expected to narrow.

The share of revenue expenditure in the total expenditure net of loan repayment for the current fiscal year has been budgeted at about 87 percent. More than half the expenditure on the revenue account would be on the payment of salaries, pensions and interest.

Rajasthan

The state’s debt to GSDP ratio for 2022-23 was estimated at 39.8 percent, which was about the same levels in the previous two fiscal years.

Rajasthan’s debt to GSDP ratio shot up in 2020-21 when its total debt stock rose more than 16 percent, while GSDP growth was just a little over 1 percent. The ratio was mostly below 35 percent before the onset of the coronavirus pandemic when growth in debt exceeded GSDP growth by a small margin.

The RBI study does not foresee any improvement in the state’s debt to GSDP ratio and estimates that it would be at current levels in 2026-27.

The state’s nominal GSDP is projected to expand by 11.6 percent to Rs 13.3 lakh crore in 2022-23 and total debt by 12.3 percent to Rs 5.3 lakh crore.

Like Kerala and West Bengal, the state’s debt is very large compared to its revenue receipts. The ratio for the current year is estimated at 247 percent.

The share of own tax revenues in the state’s revenue receipts has been around 40-45 percent in recent years and the share of taxes transferred from the Centre at 23-30 percent. Own tax revenues were estimated to have jumped 37 percent in 2021-22 when economic growth recovered.

The expansion of the economy and growth of own tax revenues as well as revenue receipts are projected to moderate in the current fiscal year due to the base effect.

The pace of expenditure growth is also projected to moderate but the quality of expenditure is unlikely to improve. Of the total expenditure net of loan repayment, 87 percent would be on the revenue account, half of which are committed expenses such as salaries, pension and interest payment.

Punjab

The newly elected government has estimated that the state’s outstanding debt to GSDP ratio at 45.2 percent for 2022-23, little changed from 45.9 percent in the revised estimates for 2021-22.

The state’s debt to GSDP has been 40 percent or more for six years. The RBI study does not anticipate any improvement in the ratio in the near term and has projected it at 46.8 percent for 2026-27.

Also read: Punjab proposes Rs 1.56-lakh-crore expansionary budget for FY23

The state has revised its estimates of outstanding debt at about Rs 2.63 lakh crore at the end of 2021-22 in the budget presented on June 27. That apart, state agencies, public enterprises and other state-owned bodies have a debt of Rs 55,000 crore, of which Rs 22,250 crore is guaranteed by the state government.

Over 50 percent of the state’s revenue receipts come as transfers from the Centre, largely in form of grants. The GST Compensation cess was a significant share of the state’s resources and the termination of the cess could set the state back by about Rs 14,000-15,000 crore, the state finance minister said in the budget speech. The share of the state’s own revenues was less than 48 percent.

The RBI study has cautioned that it was among the states the most vulnerable to fiscal shocks arising out of the realisation of contingent liabilities, particularly financial restructuring or bailout of ailing electricity distribution companies.

Click Here:- Get Live Indian Stock Market Tips From Sharetipsinfo