http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

A tale from the court of Chandragupta:

Chess was invented in India around 1,500 years ago. Apparently, the king in whose court chess was invented was very pleased with the inventor for devising such a strategically rich game.

The king, who in some versions of this fable is Chandragupta – commanded the inventor to ask for whatever he felt like.

The inventor’s request was simple, “Please give me a grain of rice in the first square of the chessboard, two grains on the second square, and eight in the third square and so on.”

Believing the request to be a trivial one, the king immediately asked his ministers to fulfill the request. To their horror, as they started filling up the squares, the ministers realized that the request wasn’t as easy to fulfill as it looked at first blush.

For the 20th square of the chessboard alone they needed over 1 million grains of rice. For the 30th square alone, they needed over 1 billion grains of rice.

But even then they thought they had the situation under control. It wasn’t until they entered the second half of the chessboard that they realized that they could not fulfill the request.

Whilst for the 32nd square, they needed 4.3 billion grains of rice, for the 33rd square (i.e. the first square of the second half of the chessboard), they needed 8.6 billion grains.

And then in each successive square, this amount doubled. By the time they got to the 64th square, they needed 18 million trillion grains of rice; i.e. a mountain of rice as high as Mount Everest.

Exhibit 1: The grains of rice increase exponentially as we go into the second half of the chessboard

The humiliated king had the inventor beheaded. However, the more interesting takeaway is the power of exponential effects – what looks like a harmless dynamic, to begin with -- can and over time, gather momentum and become monstrously powerful.

As we approach the business end of India’s five-year election cycle, we too seem to have entered the second half of the chessboard.

Prime Minister Modi’s resets

After the NDA assumed office in May 2014, in March 2015 my colleagues at Ambit wrote, “India’s strongman, Prime Minister Narendra Modi, is likely to engineer three critical resets over the next four years, namely:

(1) Shift India’s savings landscape away from physical assets towards the formal financial system,

(2) Disrupt the model of crony capitalism, and

(3) Redefine India’s subsidy mechanism”.

Once we understood the scale of Modi’s resets, we maintained a cautious stance regarding economic growth as we believed that the resets would make it difficult for capex (and hence jobs and hence consumption) to take off.

GDP growth in India has now declined for six straight quarters. Worrying developments in the second half of the chessboard

Prime Minister Modi’s resets are interplaying to create a major disruption in the Indian economy as exponential effects kick-in adversely.

Example#1: Land prices & home loans: The NDA Government passed the Benami

Transactions Act (which prohibits Benami transactions and provides for confiscating benami properties) in August 2016.

Then from October 2016, the Government made it illegal to transact in cash for transactions above Rs200000. This was then followed by demonetization in November 2016.

The combined impact of these interventions was to bring the market for rural land transactions to a standstill in the early months of CY17.

From the middle of CY17, this freeze in the land market started impacting home loan providers. Why?

Because these home loan providers perhaps unknowingly were giving loans which were being used to buy rural land, in the hope that the land would be flipped in a couple of years. With flipping having come to a standstill, these loans are now becoming NPAs.

As the promoter of a listed company in Tamil Nadu told me last month, “Even if I halve the price of my rural landholdings, there are no buyers.” The MD of a listed bank in southern India told me last month that “Wherever I have land as collateral, it has become very hard to encash that collateral.”

Example#2: RERA (Real Estate Regulatory Act) & home loans:

The NDA Government passed RERA in March 2016 and the Act came into effect on May 1, 2017. Within five months of the Act being implemented in Maharashtra, residential property under construction has got delayed further.

According to a report by property consultancy Knight Frank India, several residential projects that were to be handed over to buyers this year have witnessed an extension of delivery timelines.

The findings of the report indicate that more than 50 percent of the residential units registered with RERA have extended their time period for completion by over a year, and 30% will have an extended deadline of more than two years.

The report further stated: “The timelines for 57% of the registered units that are under construction have been revised by more than a year. Among them, for 24% of the 107,875 registered units, the completion deadline has been pushed to between a year and 18 months while 19% will be delayed by between 2-4 years and the remaining 10% would not get completed before four years.”

In a note dated August 24, Ambit’s Banks team had highlighted that “Home buyers in delayed projects in NCR are considering stopping EMIs and a prominent builder in Pune has stopped paying EMIs to lenders under the subvention scheme.

We believe that unless project completion is ensured by the Government or a third party, the probability of default remains high given low borrower equity. Our guesstimate indicates that the overall system gross NPAs in home loans could increase by 70-170bps if 30-70% of the borrowers default.

Moreover, loss given defaults can also be higher than expectations if haircuts exceed 30% for homeowners (likely due to inventory glut and declining prices in NCR).”

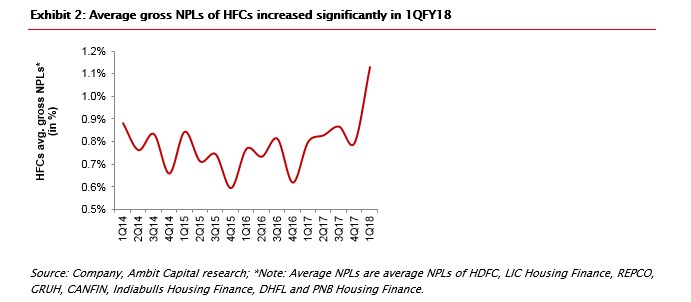

If the effects highlighted in italics above play out and mortgage lenders’ NPAs continue rising as sharply as they have done in the past six months, it won’t be long before lenders’ cost of funding begins to rise (see exhibits below).

They will then, in all likelihood, start passing those costs on to borrowers which will exacerbate the credit quality issues.

Exhibit 2: Average gross NPLs of HFCs increased significantly in 1QFY18

Example 3: The attack on black money & jobs in the age of automation:

The Indian Government spends as little as 3.3 percent of GDP on education (compared to 5.1% for Malaysia, 5.8% for Thailand, and 4.1% for Indonesia). Unsurprisingly, when most Indians enter the job market, they possess very little by way of skill.

To compound the problem, the age of automation is upon us – as pointed out in October 2016 by the World Bank President, 69% of the jobs which are currently done in India will be automated or mechanised over the next 20 years.

Now, over and above these two forces comes a third force – the attack on tax evading companies. I reckon India’s tax evading companies end up accounting for 80% of its jobs (source: National Sample Survey Organisation).

It is almost certain that the overwhelming majority of India’s job growth in the past decade has come from India’s informal sector (since the key drivers of the formal sector – IT, Financial Services, manufacturing – have moved increasingly towards automation

– for details see my 20th February note).

Tax evasion gives these companies a cost advantage of 10-30% (of revenues) relative to the organised sector. The crackdown on black money and tax evasion are hitting India’s SME sector and causing job losses.

How can I be so sure? Because I am seeing the NREGA spend numbers rocket from Rs 360 billion in FY15 to well over Rs 700 billion in FY17.

Conclusion

A combination of India’s longstanding shortcomings (especially its inability to train and educate its people), worldwide changes in the ability of machines to replace workers in factories, and Prime Minister Modi’s resets (especially his multi-faceted crackdown

on black money) is creating serious pain for the Indian economy.

This is leading to an economic slowdown which looks likely to accelerate as the after-effects interplay with each other. The slowdown is resulting in job losses – especially blue-collar job losses – and a broad-based deterioration in the land and real estate

markets.

Investors who ignore these effects and continue to pile into expensive Indian stocks (even as earnings estimates are continuously pulled back) are treading on water.