http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

Saptarshi Mukherjee had planned to attend a computer science programme at a California-based educational institute in 2019. The course fee was approximately Rs 40 lakh a year but Mukherjee presumed it wouldn’t be tough to secure an education loan for a programme in the US. He was mistaken. Three banks — two public sector banks and one private bank — rejected his application as his family lived in rented accommodation.

Ashna Sharif, now pursuing an architecture postgraduate course in London, said that two banks — one public sector and one private — had raised questions about her failing one year during her degree programme, which was due to her falling ill, and rejected her loan request.

With the financial position of Indians worsening amidst the pandemic, hopes of students getting a bank loan are turning bleak. So, many candidates are now pursuing other options to raise funds.

Saptarshi Mukherjee’s father finally decided to take a Rs 25 lakh personal loan from a non-banking financial company at a 13 percent interest rate. The rest came from their personal savings and hypothecation of gold jewellery. “We had kept aside a Rs 7 lakh corpus for medical emergencies, which has now been used for Saptarshi’s education,” said his father Badrinath Mukherjee.

Ashna Sharif’s parents took a gold loan since the banks were in no mood to lend. “It is almost as if they are looking for an excuse to reject the loan application,” she told Moneycontrol. The family took a Rs 15 lakh gold loan at an interest rate of almost 12 percent. The hope is that she will be able to find employment by 2021 and repay the amount.

On the back bench

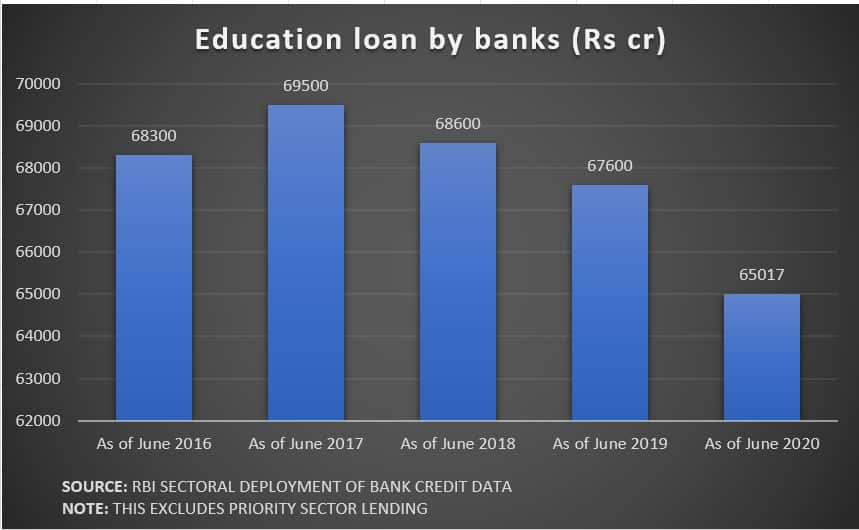

Reserve Bank of India (RBI) data on sectoral deployment of bank credit shows that there has been an 8.43 percent decline in education loan disbursal (excluding priority sector lending) as of June 2020 to Rs 65,017 crore, compared to the highest level of Rs 71,000 crore, in November 2016. This is a year on year decline of Rs 2,583 crore or 3.8 percent.

RBI data for sectoral deployment of bank credit shows the exact quantum of loans given by these institutions to various sectors. Here, loans for educational purposes have seen a consistent decline and have now flattened to around Rs 65,000 crore.

For students this is tough because specialised higher education programmes in India and any course abroad cost upwards of Rs 10 lakh.

With banks out of the reckoning, students and their families are turning to other financial institutions, gold loans, dipping into the retirement corpus, part-time jobs and crowdfunding.

Pritam Saxena, from Gwalior, was able to raise Rs 2 lakh for his sister Anchal’s hotel management course within four weeks through on online platform. He said that the family did not have any collateral to place for a bank loan and hence they were forced to take this option.

Ramesh Srinivasan, from Chennai, who will be flying to Italy to pursue a course in Design in 2021, has started working to build a corpus of Rs 20 lakh, which he will require immediately. “Based on my interaction with the alumni, I have shortlisted two part-time jobs which will help me pay the mess fees. I have applied for a 40 percent scholarship and in case that doesn’t work out, I will start doing freelance jobs on website development, in which I have some experience,” he added.

Rise in delinquency

While there has been no decline in the number of students pursuing higher education and specialised programmes, banks are wary of the dwindling employment prospects of students and hence the rise in defaults.

“We have seen a rise in delinquencies by students and hence loan disbursal has been very selective. There is a consensus among bankers that loans should be restricted to the top institutes that have a good track record for employment,” said the general manager of a mid-sized public sector bank.

While industry data for FY20 are not available, banking sources said that education sector NPAs stayed close to 8.3 percent for the quarter ended March 2020. This is an almost 100-basis-point jump since March 2017.

And yet, while banks are going cautious, overall education loan disbursals have increased. Data from CRIF High Mark showed that the education loan book, which includes banks, NBFCs and other financial institutions, stood at Rs 92,711 crore at the end of March 2020. The figure at the end of FY19 was Rs 90,345 crore.

There has also been an increase in the average ticket size of education loans, from Rs 3.94 lakh in FY19 to Rs 4.31 lakh in FY20.

However, there has also been a rise in delinquency or delays in payment of the loan interest. CRIF High Mark data showed that 7.19 percent was the delinquency beyond 360 days at the end of FY20. This meant that 7.19 percent of the education loan book had seen payment delays of one year and above.

This delinquency rate stood at 5.86 percent in the year-ago period, CRIF High Mark data showed.

“Since May-June 2019, we have seen a rise in payment delays by education loan customers. This is making it riskier to lend to this segment,” said the head of personal loans at a private bank.

A rise in delinquencies has also led to banks to seek more documentation and detailed academic records, which has played a dampener for students.

Other lenders step in

With banks not viewing education loans as an attractive segment, customers are gravitating towards other financial institutions.

Amit Gainda, Chief Executive Officer, Avanse Financial Services, told Moneycontrol that education is an essential spend in every household.

“Avanse Financial Services takes a student-centric approach rather than depending only on the co-borrowers’ financial background. As a part of this approach, we evaluate the student’s profile: past academic performance, entrance test scores, university/institute ranking and course selection,” said Gainda.

Gainda added that through this approach, the company is able to assess the employment potential of the student.

Student aspiring to study at an Indian Institute of Management or Indian Institute of Technology will be easier to secure an education loan from a bank. However, a traditional bank would be unwilling to provide a loan for unconventional courses like music, animation or photography.

That is where players such as Avanse Financial Services come into the picture. Gainda said the company lends to students pursuing both traditional and non-traditional programmes.

With loan moratoriums being granted amidst the pandemic and students defaulting due to no placements in 2020, it is unlikely banks will return to lending aggressively to the education sector. More and more students may therefore have to explore non-bank funding options.