Policy measures announced by the Reserve Bank of India (RBI) on Wednesday will be a shot in the arm for the economy as well as companies in the Micro, Medium, and Small Enterprises (MSMEs), financial, and healthcare space.

Policy measures announced by the Reserve Bank of India (RBI) on Wednesday will be a shot in the arm for the economy as well as companies in the Micro, Medium, and Small Enterprises (MSMEs), financial, and healthcare space.

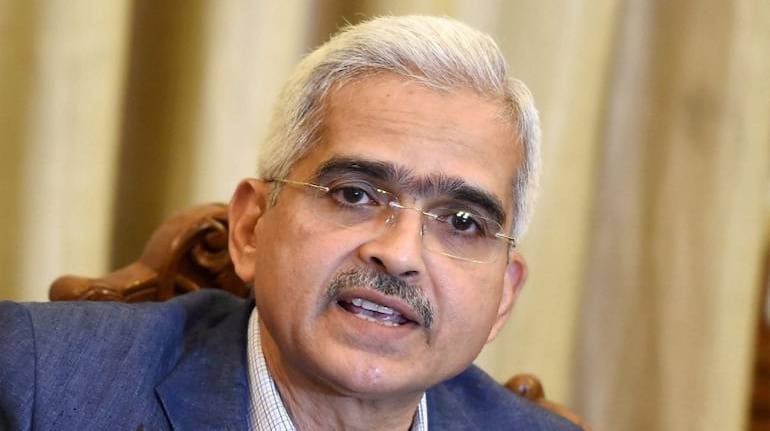

RBI Governor Shaktikanta Das announced a set of fiscal measures to tide over the second wave of COVID-19 cases.

The market reversed losses and closed with handsome gains, despite a rise in COVID cases across the country. RBI’s relief measures came well in time when the second wave of COVID-19 is gripping the country.

Experts spoke to are of the view that stocks from small finance banks (SFBs), housing finance banks (HFCs), medical equipment manufacturers, healthcare, banks, NBFCs, and hospital sectors are likely to benefit the most from the measures announced.

Das announced the second tranche of buying of government securities (G-Secs) under the Government Securities Acquisition Programme (G-SAP) 1.0 to be conducted on May 20, 2021.

“The announcement of the second tranche of bond buying to the tune of Rs 350 billion is likely to further soften bond yields. Overall, the RBI measures certainly bode well for banks and NBFCs,”

On-tap liquidity of Rs 50,000 crore at repo rate is being opened till March 31, 2022. This will bode well for the health infrastructure space.

Das opened an on-tap liquidity window of Rs 50,000 crore with a tenor of up to three years at a repo rate.

“The inclusion of Micro Finance Institutions (MFIs), with an asset base of up to Rs 500 crore in SFBs’ lending radar with new funds will help the weaker sections of the industry to cope up with COVID resurgence,” Mohit Nigam, Head, PMS, Hem Securities, told

“These measures will somehow provide a cushion for the financial system, which lends to small hands, and, hence, restrict any severe impact to the system. SFBs, HFBs, medical equipment manufacturers, healthcare, and hospitals are some of the sectors which shall benefit the most out of today's relief measures,” he said.

The restructuring resolution for borrowers for up to Rs 25 crore received a thumbs up.

The RBI announced fresh restructuring resolutions for individuals, small businesses, and MSME borrowers who have an aggregate exposure of up to Rs 25 crore.

“RBI has largely addressed the need of small borrowers, individuals as well as businesses, and MSMEs that have been among the worst affected in the second resurgence of

COVID,” Naveen Kulkarni, Chief Investment Officer, Axis Securities, Besides liquidity measures, easing lending to the above strata by extension of restructuring resolutions, and boosting medical infrastructure through PSL recognition will help bring in relief in the financial ecosystem,” he said.

Read Also:- Get Share Market Tips With High Accuracy