Potash consumption will probably fall to 3 million tons in the year through March 2023 from 5 million a year earlier, according to P.S. Gahlaut, managing director of Indian Potash Ltd., the country’s top importer of the crop nutrient. Farmers have been using less of it to grow crops like rice, wheat and sugar.

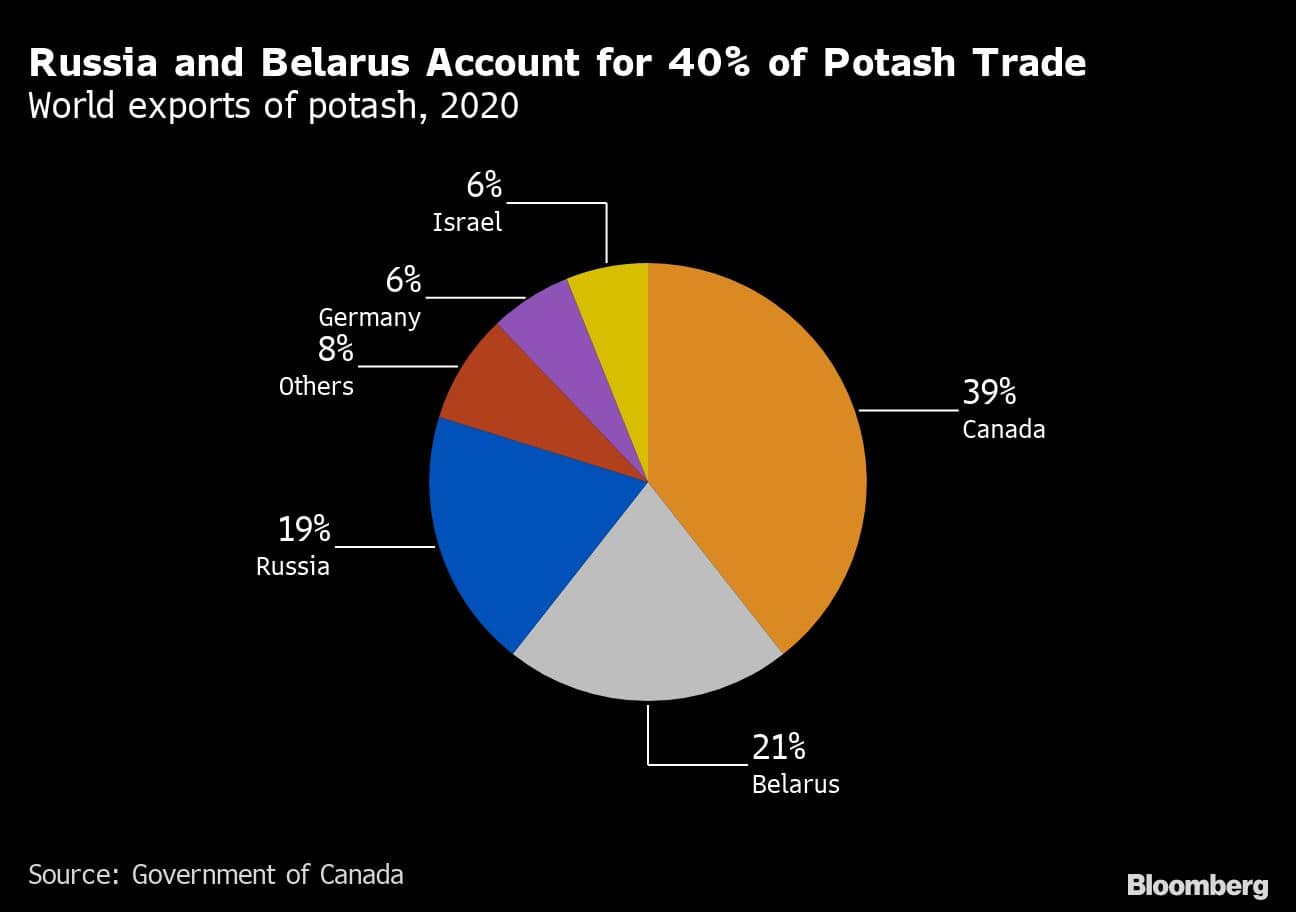

Potash is a fertilizer that helps plants withstand drought and diseases. Prices soared earlier this year after the invasion of Ukraine, with many shippers, banks and insurers avoiding trade with Russia even though fertilizers are not directly targeted by sanctions. The industry is also contending with US and European Union sanctions on potash sales from Belarus, as well as China’s move to restrict exports to protect its domestic market.

Indian Potash has agreed to buy the crop nutrient from Israel, Canada, Jordan and Germany this year at $590 a ton including freight charges, up from around $445 last year. Supplies from Russia and Belarus, two of the three biggest exporters, have come to a standstill because of payment issues, Gahlaut said.

Our potash availability is comfortable,” Gahlaut said in an interview last week. “The sad part is potash demand has gone down because of high prices.”

Indian Potash will begin annual price talks with suppliers including Russia’s Uralkali PJSC, Israel’s ICL Group Ltd., Arab Potash Co. in Jordan and Canada’s Canpotex Ltd. in November, he added. “People are giving us visits but we’re in no hurry to finalize the price.”

Gahlaut expects global fertilizer prices to decline by 10% to 12% next year due to high stockpiles. Prices will fall further in 2024 as supplies improve, he said.

In India, some farmers have skipped potash application but that’s not having a major impact on crop yields -- at least for now -- as there’s available supply in the soil. It may start affecting agricultural production if they skip potash use continuously for two or three planting seasons, Gahlaut said.

India’s potash consumption fell by about 50% in five months through August from a year earlier, while demand for NPK fertilizers -- the three main nutrients in commercial fertilizers that represent nitrogen, phosphorus and potassium -- has shrunk 20% over the same period, he estimates.

Demand will likely stay flat this winter sowing season unless the government increases the subsidies for fertilizer companies, Gahlaut said. The authorities have said they won’t allow those firms to increase their prices. India is set to announce subsidies soon for the winter season.

“We hope the government is going to increase subsidies. It should be available at an affordable price to boost consumption,” Gahlaut said.