http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

Consumer durables companies took a hit in May 2017 when it was announced that Goods and Services Tax would be levied on almost 80,000 products. GST for white goods, including refrigerators, washing machines and air conditioners was set at 28 percent, the highest among the four tax slabs for goods and services.

The sector received another blow when it was announced that there will no extension to the implementation of the tax and that it would come into effect on July 1.

At the time, dealers started making frantic calls to company representatives to understand what GST was all about. The entire inventory had to be re-labelled, systems had to be reconfigured and discounts (if any) had to be immediately passed on.

The situation was tricky as 28 percent tax on goods had a direct impact on production costs. Moreover, a sudden increase in prices would lead customers to postpone their buying decisions. Unsold inventory also would have to be priced differently as compared to fresh stocks.

“The first three to four weeks were a nightmare. Customers wanted discounts because they presumed we were being offered a lower rate of tax, dealers threatened to shut down sales if we didn’t help with the technology upgradation. All prior sales targets had to literally thrown into the bin because we didn’t know what penalties we could face,” the national sales head for a global appliances major said.

As the GST Council had just started to meet, manufacturers had a unanimous request that taxation should be brought down to 18 percent instead of 28 percent. However, the demand has not been met since.

Sales take a hit

In the initial months, when the processes were unclear, sales of consumers durables declined. Customers were not making purchases and dealers refused to stock more than a few thousand goods.

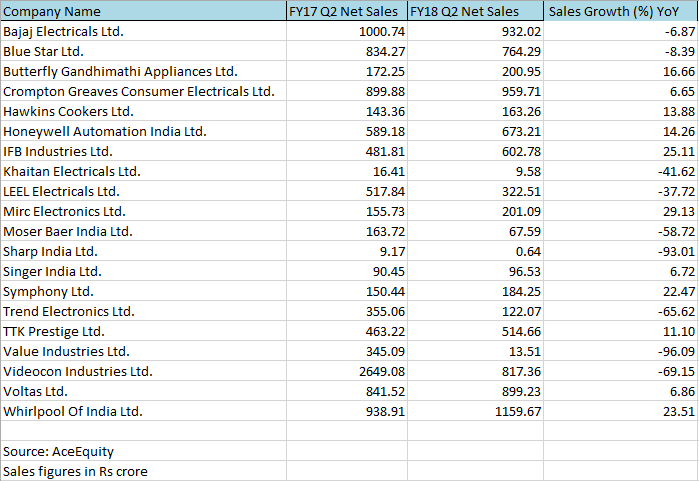

In the second quarter, sales data of most companies saw a clear dip and firms had anticipated the decline.

Vivek Saran, Head of Sales, Mirc Electronics said that there was some impact on sales during the July to September quarter in FY18 as trade (dealers) restricted buying for some time and wanted things to be streamlined. Sales normalised from the following quarter.

“Since traders were liquidating their old stocks at huge discounts till June 30 to reduce their inventories, consumers also preponed their festive purchases,” he added.

Sales of key players sees drop

Another dealer from South Mumbai who stocked all domestic appliances said that for certain products like LED televisions, they ran out of stock during the last few days before GST was implemented.

“We had never faced a situation like this. We had angry customers wanting to buy products and there was nothing we could do because we were running out of inventory. Discounts ranged from 25 percent to as high as 35 percent but stocks were limited,” he added.

Mathew Job , CEO, Crompton Greaves Consumer Electricals said that during the implementation of GST, there was some impact on sales due to destocking in the channel. Things have slowly returned to normal over the course of time.

“We helped our trade partners by conducting training sessions and seminars explaining the impact of GST as well as ensuring their preparedness. We also supported them by reimbursing them for the losses that they suffered on the transitional stock,” he added.

Puzzled customers vent out

On one hand, the government announced that there would be heavy penalties for any profiteering move by companies. This meant that even if there was a marginal relief for some companies due to the input tax credit on closing stocks, it had to be passed on.

Customers presumed that white goods would get cheaper. On the other hand, prices for most products either remained same or were increased marginally. This led to the confusion among buyers.

The Central Board of Excise and Customs (CBEC) had constituted a toll-free helpline where customers started to file complaints.

Abhishek Saraoge, a 35 year software engineer from Bengaluru said, “A double-door refrigerator that we were planning to buy saw a price increase of Rs 6,000 in two days. We had to drop the plan of purchasing it and waited for three months before finally buying it online.”

Social media was also abuzz with customers venting out their frustration over non-availability of products as well as price tweaks being made.

Normalcy settles in

Kamal Nandi, Business Head and Executive Vice President, Godrej Appliances said that the new GST regime did bring about some ease of doing businesses.

“The elimination of the state boundaries for transporting goods have facilitated direct deliveries from the plant to the trade partners. This also gave manufacturers the option of consolidating warehouses, optimizing logistic cost,” he added.

He explained that post implementation, GST improved supply chain efficiencies for the industry. GST has brought ‘borderless delivery’ by enabling companies to deliver directly from manufacturing plant to the dealer. In pre-GST era the material would go from the plant to our local warehouse and then to the dealer warehouse. Direct delivery helps in improving response time for markets. Now, there is an opportunity for warehouse space optimization as well.

This year, Godrej is planning to do 20 percent of their deliveries directly from the plant to dealers.

Players wait for tax reduction

Nandi said that with increased commodity prices and repo rate coupled with the strengthening of the dollar the input cost for appliances increased leading to a price hike of 2-3 percent, making appliances unaffordable.

“Any reduction in the tax slab will help offset this hike, which would be beneficial to the customers and lead to a spur in demand, thereby augmenting economic growth in the manufacturing sector,” he added.

Consumer durables companies have met the GST Council time and again to press for the 18 percent tax slab demand. While an immediate revision in the tax rate is not on the anvil, the GST Council could consider the request in the next few months.