The Reserve Bank of India is expected to increase its policy rate by half a point for the third time in a row as the currency’s plunge to a record low this month complicates the battle against inflation.

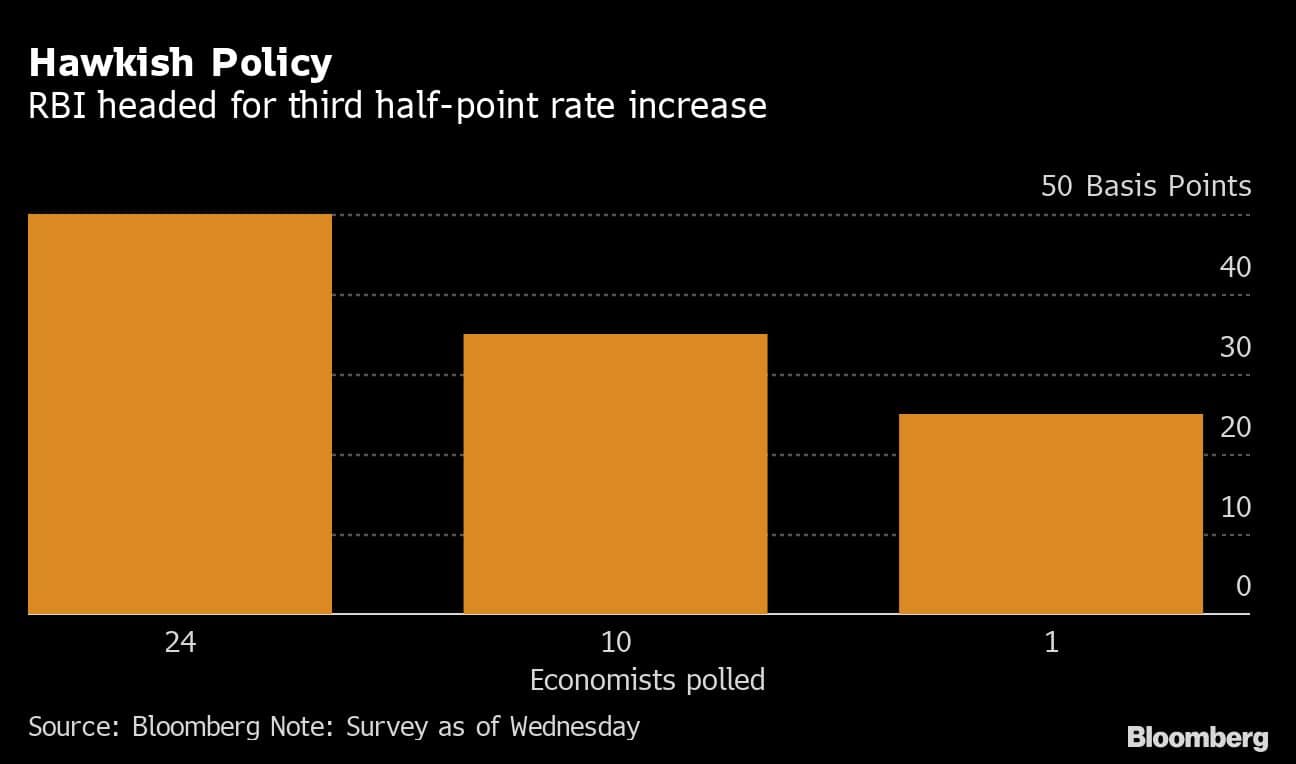

The Reserve Bank of India’s six-member monetary policy committee will raise its repurchase rate by 50 basis points to 5.9%, according to 34 of 46 economists surveyed by Bloomberg as of Thursday. Eleven forecast the rate will rise by 35 basis points to 5.75%, while one sees a quarter-point increase.

Governor Shaktikanta Das may opt to dial up his hawkish rhetoric from his tone at the August meeting when he pledged to do “whatever it takes” to cool inflation that has stayed above 6% this year. Since then, India’s price gains quickened anew and the currency slump deepened as the Fed raised rates by 75 basis points for a third consecutive time and amplified a hawkish signal while warning of a painful slowdown needed to curb US inflation.

“The biggest point of worry currently is the significant depreciation in the currency,” said Upasna Bhardwaj, chief economist of Kotak Mahindra Bank Ltd. Deteriorating reserves curtail RBI’s ability to intervene so “higher interest rates will have to be maintained with hawkish tone in the policy to support the rupee.”

Here’s what to watch out for when Das addresses media:

Oil, Food Prices

With oil prices falling below $80 a barrel from more than $120 in June, the RBI will probably revise its oil price assumption on Friday from the $105 level it factored in previously. It’s unlikely to make any significant changes to this year’s 7.2% economic growth forecast, or 6.7% inflation outlook, given pressures from food grain prices.

“The inflation-growth mix is likely to remain tricky,” HSBC Holdings Plc economists led by Pranjul Bhandari wrote in a note this week. They expect the RBI to hike by 50 basis points each at the September and December meetings and see average inflation staying above the 4% mid-point of the RBI’s target range in the current and next fiscal years as economic growth slows.

In a separate survey by Bloomberg on India’s economy, retail inflation is seen to average at 5.1% next fiscal year from a 6.6% estimate in the year ending March while the latest projections on economic growth moderated to 7% and to 6.1% for fiscal years 2023 and 2024. Economists polled on the policy path expect the key rate to rise by another 25 basis points by March 2023 after a half-point hike on Friday.

FX Reserves

The rupee is down about 10% this year and trading near a record low even after the RBI mounted a staunch currency defense in the past year -- evident from an almost $100 billion drop in its foreign-currency reserves, with some of the decline attributed to revaluation. Das had said the reserves “provide a cushion against external shocks.”

A broad consensus among market participants was that anything lower than a 50 basis-point hike, or the governor sounding less hawkish may push the currency even lower.

“Rupee readjustment is catching up faster than peers, as it was held artificially stronger in past adjustments by policy intervention,” Madhavi Arora, lead economist at Emkay Global Financial Services wrote in a note, “The FX war chest has already dipped an estimated more than $100 billion, while the war is still pretty much on.”

Bonds, Liquidity

Bond traders are watching for signs from the central bank on how it plans to manage liquidity in the financial system that’s been tightening.

While the RBI’s intervention in the foreign-currency market is reducing the supply of rupees, increased domestic activity after a broad reopening from virus restrictions has contributed to the strain.

The liquidity crunch along with RBI’s rate hikes are reflected in rising shorter-term borrowing costs. Five-year yields are edging higher than benchmark 10-year notes, and a flattening yield curve is delivering the narrowest spread between 10- and 2-year yields since 2020.

The bond market is also awaiting the results of index reviews by FTSE Russell and JPMorgan Chase & Co. and whether or not India will be included.