A shopper browses clothes in a market in Lucknow, India, on Wednesday, Oct. 13, 2021. The Reserve Bank of India expects the months-long festival season to bolster urban demand in the second half of the financial year to March 2022, while rural demand will likely be buoyed by a robust monsoon and record food grain production.

Indian consumers expecting retail inflation to cool in tandem with easing wholesale prices are in for disappointment.

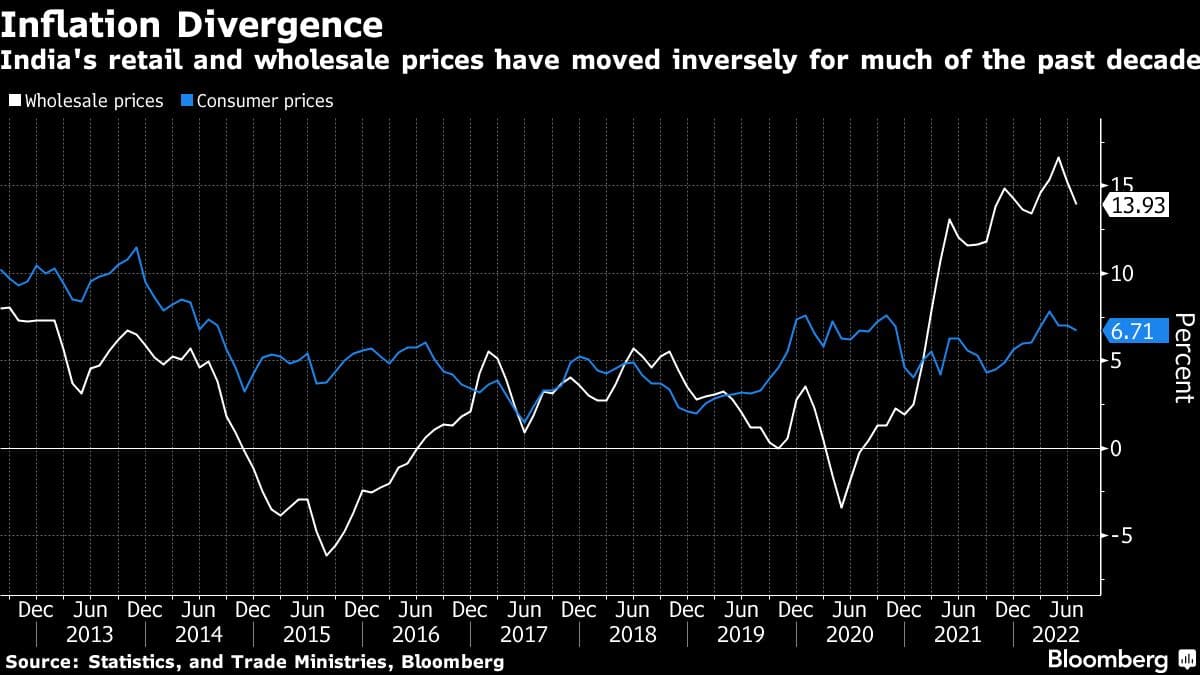

That’s because the consumer price index, currently hovering above the central bank’s 2%-6% target band, has shown little correlation with the wholesale measure in the past decade. And if historical trends are any indication, the two indexes have had an inverse relationship for the most part of that period, which analysts attribute to the pricing power of most businesses.

Data due later Monday will probably show retail inflation quickened to 6.9% last month from a year earlier, according to a Bloomberg survey of economists as of Sept. 10. That compares with estimates for wholesale price inflation easing for a third straight month to 12.9%, in numbers scheduled for release Wednesday.

With wholesale prices galloping in double-digits since April last year, companies found themselves in a fix -- raise prices too much and hurt a nascent recovery in demand or absorb costs and take a hit to profitability.

While many consumer-goods makers including Hindustan Unilever Ltd. and ITC Ltd. and Maruti Suzuki India Ltd. raised prices during the period, the increases were probably not enough to cover elevated costs. Maruti, Tata Motors Ltd. and Larsen & Toubro Ltd. reported a hit on their income in the April-June quarter due to high input costs and supply chain constraints.

As the gap between WPI and CPI narrows, firms will be reluctant to pass on the benefits of falling global commodity prices to retail consumers because they will likely look to recoup their margins, said Rahul Bajoria, an economist with Barclays Bank Plc.

That implies retail prices could take longer to fall back within the central bank’s target band of 2%-6%, belying expectations of some consumers and keeping the Reserve Bank of India on course to tighten further when its monetary policy committee meets later this month. The RBI, which has returned borrowing costs to pre-pandemic levels with 140 basis points of hikes since May, expects inflation to average 6.7% in the year to March.

Sticky Inflation

As the wholesale price index falls, “lower input costs will be used by firms to offset the ongoing margin squeeze, thereby keeping CPI inflation sticky,” said Sonal Varma, an economist with Nomura Holdings Inc., who expects the headline print to remain above 6% until February.

Global commodities prices are seeing a moderation amid fears of a slowdown caused by a US Federal Reserve-led monetary policy tightening. As a result, wholesale inflation is seen easing to less than 5% in the next one year, falling below consumer prices gains for the first time in more than two years, according to a Bloomberg survey.

There is a risk that the pass-through of past increases in input costs could continue, partly offsetting the favorable impact of recent fall in commodity prices, rate-setter Rajiv Ranjan said in the minutes of RBI’s latest policy meet.