http://sharetipsinfo.comJust get registered at Sharetipsinfo and earn positive returns

The mobile app facility will be rolled out on June 7, 2021, along with the new ITR e-filing portal.

As per the tax law, individual taxpayers filing ITR-1 or 4 are required to file their return for the previous fiscal year (2020-21), which ended March 2021, by July 31, 2021.

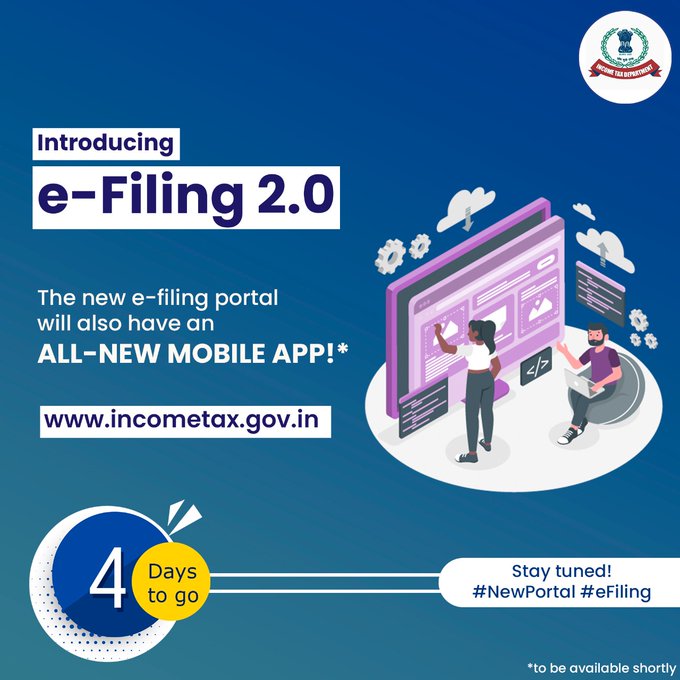

One can use his/her mobile to file an tax return or ITR filing. The tax department of India informed about the event from its official Twitter handle saying the tax e-filing portal 2.0 will have an all-new mobile app also .

The tax department claimed that the new IT return e-filing portal and therefore the new mobile app are going to be easy to use for taxpayers. it'll enable taxpayers to collect information like ITR form, pre-filled tax details, Saral tax facility, etc.

The mobile app facility are going to be unrolled on June 7, 2021, along side the new ITR e-filing portal.

The tax department is functioning on compliance check utility also . While replying to a question of a taxpayer, the tax department said, "The ‘Compliance Check Utility’ for deductors/collectors for determining the applicability of section 206AB/206CCA (including bulk mode) is under development and can be made available soon."

For further information to the income taxpayers, all important features of the tax portal available on the desktop are going to be made available on the tax mobile app also . The tax mobile app are going to be enabled subsequently for full anytime access on a mobile network.